Continuing on that mathematical wild goose chase, wherever it may lead.

I liked that term so much I decided to use it in this week’s title. I refer to Physics StackExchange for this succinct discussion of canonical coordinates (Wiki) in mechanics and thermodynamics—the former symplectic, the latter contact.

Recall we had stated the dynamics imposed by the generating function G(q,p,s)

This contains a new variable s: what’s that about? Interpreted in an economic context?

The short answer: money. (Long answer in the rest of the post.) Notice the dimensions in the equations above: the first shows that G must have units [€]/time, the last shows s must then have units [€] since its flow has the same units as G. So s, though a quantity variable, has the same units in which we measure value.

Find the previous posts in this topic here, I’ll assume you’ve read them. And if you want a preview of what’s coming, I had never linked to Wikipedia’s page on contact structures and how they relate to symplectic structures.

Shadow prices

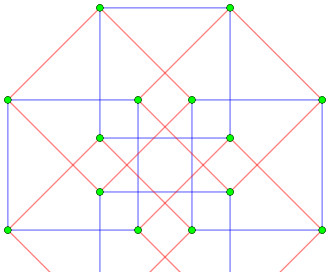

Recall that we had argued that equilibrium occurs when there is a utility function U(q) so that θ = dU. But then it is interesting to consider the form (θ-ds), for some variable s in ℝ, not in Q, with units of utility. This so-called contact form (Wiki) identifies equilibrium when it vanishes so θ-ds = 0, and there it is a graph s = U(q). In a certain sense s then measures the distance to equilibrium.

When we do have equilibrium θ = dU, in coordinates this requires pⱼ = ∂U/∂qʲ that prices equal the shadow prices defined by U(q).

Extension

This perspective puts ℝ(s) apart from Q, i.e. separate from the main state space. The units of s don’t really matter, but it does matter that all prices are expressed in terms of these units. Writing [€] is just a placeholder, it could be [$] or [utility] or [leisure-hours]—relabeling the units is a symmetry. Thus s determines a unit of account, one of the traditional roles of money.

Projectivization

Another way to interpret s is as a medium of exchange, another role of money. We designate one of our existing quantities q₀ in Q to be the measure of all prices. All prices will be expressed with respect to that q₀, and its own price will be fixed to always be 1 by definition. This is like using gold or silver coins for payments. Rewrite s≝q₀ and define prices in new units, by dividing them throughout by its price p₀.

(Mathematically this is called projectivization and is a (second) way to get a contact space out of a symplectic space1.)

Maxwell relations

A final comment returning to shadow prices. In equilibrium with pⱼ = ∂U/∂qʲ we have what are known as the Maxwell relations (Wiki) in physics:

In his textbook Foundations of Economic Analysis, Paul Samuelson (Wiki) credits Harold Hotelling (Wiki) for introducing these in economics. It is not intuitive that price-sensitivities should be related in this way, but since the derivatives are symmetric it is mathematically trivial when described in this way.

I note this because when we have such a geometric description of our system, the Maxwell/Hotelling relations are gratis: we don’t have to impose them on the model. A utility function U(q): Q → ℝ completely determines an equilibrium subset in phase space T*Q by describing the prices p associated with every state q2. The geometry takes care of the bookkeeping, and we can concentrate on what characterises the economic system we are interested in.

It is an informative exercise to derive (*) from the Hamiltonian dynamics of the overarching symplectic space.

This was recognized in thermodynamics by JW Gibbs (Wiki), who taught Samuelson’s mentor EB Wilson (Wiki) and so influenced his graphical view of economic equilibrium. Gibbs distinguished these relations from equations of state (Wiki), which gave physicial rather than mathematical meaning to the system.

Equilibrium spaces of this form are called Lagrange manifolds in T*Q or Legendre manifolds in the extended T*Q ⨉ ℝ(s) in geometry.