This post kicks off a series on mathematical economics. It will not appeal to everyone.

Last week I introduced dimensions in economics. This week I will discuss the notion of arbitrage, and how it can be described by a little-known mathematical structure. You will have to bear with me on this one.

Arbitrage (Wiki) in a market is roughly a series of trades that leaves you with the same things you started with, but more money. It’s a trader’s dream but a theorist’s nightmare, so though it inevitably occurs in large dynamic markets1 (at least in the absence of transaction costs) most models assume it must vanish2. The argument being, that once people trade on an arbitrage opportunity their counterparties adjust their prices and the opportunity diminishes—until it disappears entirely. In the absence of market distortions you should not be able to trade Euros for Dollars, those for Yen, and back to Euros, ending up with more3 Euros than you started with—this puts a condition on the three pairwise exchange rates.

So absence of arbitrage is a natural condition for an economic concept of stability. The very idea of arbitrage also imposes some requirements on an economic model, which seem obvious but I will spell out because I am a mathematician:

There are multiple quantities qʲ that can be traded (units denoted [qʲ]);

There is some kind of value-measure (units [€]) we are interested in;

The quantities have associated prices pⱼ in [€]/[qʲ] that express their value.

We are not saying what q should be or how p should be determined; and value could be a monetary value (as suggested by €) or utility or gold or leisure-time or any other unit of account. We are saying we need at least these variables in our model to measure value changes, because only then can we express the value-added of a trade ðq (small enough to not change prices) as

All terms in (1) have units [€] so they can be added together—even if q^1 counts apples and q^2 counts oranges which, idiomatically, cannot themselves be compared. A no-arbitrage condition means a series of trades that begins and ends in the same state (q,p) should not create [€] value in this sense.

As an aside: the convention4 of putting indices in subscripts on pⱼ’s and superscripts on the qʲ’s is to distinguish transformation behavior, units of quantities are [qʲ] and price units are proportional to [qʲ]^{-1}—so if you change your measure of length from yards to feet (times 3) you should adjust prices oppositely (price-per-foot is 1/3 of price-per-yard). This means that a product like pⱼ qʲ has units [€] that do not depend on the scale, as any changes cancel—hold on to that thought.

Different kinds of variables

I mention the transformation properties because that is an indication of the underlying structure. Geometric notation allows us to distinguish these kinds of variables explicitly, as describing different spaces.

We begin with quantities (or stocks). We write Q to denote the whole configuration space, we write q for a point identifying a particular state:

\(q \in Q\)Next we consider flows: changes to stock quantities over a (short) period. Their dimension is [q]/time, the tangent space at q contains all vectors \dot{q}5 starting from that point.

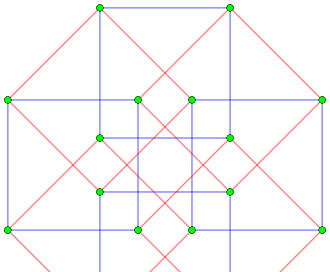

\((q,\dot{q})\in TQ \qquad \dot{q} \in T_qQ \cong \mathbb{R}^n\)We’ve seen we need prices. with dimension is [€]/[q], where [€] is the arbitrary measure of value. The co-tangent space at q is all co-vectors p based at q. Think of a co-vector as the hyperplane at right angles to a normal vector.

\((q,p) \in T^*Q \qquad p\in T^*_qQ \cong \mathbb{R}^n\)The value itself is some measure in the real numbers ℝ

\((\bullet, \bullet): TQ\times T^*Q\to \mathbb{R} \qquad \forall q\in Q, (\dot{q}\in T_q Q, p\in T^* Q)\mapsto (p,\dot{q})_q \qquad (2)\)

This is a lot of notation but the interpretation is intuitive. The value follows from applying a price (co-vector) to a flow (vector) at any state q. But for now my point is that this value is another kind of variable, it doesn’t live in TQ or T*Q.

The value one-form

The amount of notation in the last expression indicates we’re starting to do math6, as it introduces a fundamental geometric object. This article on Wikipedia is daunting as it puts all the notation I just introduced in a couple of paragraphs. It discusses a form that in coordinates is given as:

θ takes a flow, a vector, and returns a value, as above in expression (2). (So it is not a function of states q but of flows out of that state.) In our economic context it is the value change, at given prices p, associated to that flow, just like expression (1). And that had units [€] that don’t depend on the coordinates [qʲ] in any way.

Writing d rather than ð can be interpreted as being infinitesimal, that the form can be integrated along a continuous path rather than summed over a sequence of trades. When this evaluation is not 0 on a cycle, it is picking up some kind of arbitrage. When it is 0, it means that the proposed flow satisfies some kind of budget constraint—and the trades are in some sense economically viable.

This form has turned up in many different guises in science and so has many names: tautological, canonical, symplectic, Liouville, or Poincaré. There is a beautiful way to introduce θ without any reference to coordinates, but that is not intuitive to a geometer let alone anyone reading this blog. I mention it because if it can be defined without reference to coordinates, it has to be invariant to coordinate changes. Just as the product pⱼ qʲ doesn’t depend on scale [qʲ], this relation doesn’t depend on choice of coordinates in any way. (Except, and this is important enough to mention, if we scale all prices by a similar factor—we could go from € to $ for instance.)

This whole post has been quite abstract7: what are the q’s counting, anyway? But that is the point: no matter what the (economic) context, there exists a way to measure value (because we’re interested in an economic model). We can change coordinates, and then quantities, prices and even units-of-measure change but not the fact we can measure them. And the formula for value is still given by expression (3) in new coordinates!

An example in macro-economics is the identity of national income and national product: what an economy sells and what it buys must equal (ignoring trade) and so measuring production and measuring income are descriptions of the same underlying activity in different coordinates! This observation leads to accounting identities that real economists really use.

More about implications of this later.

Remember when people traded up from a paperclip to a house?

Arbitrage pricing theory is built on this assumption.

Or less! You could then reverse the trades for profit.

From physics, known as the Einstein summation convention.

The dot-notation for changes-over-time is due to Newton, since I’ve started name-dropping.

But still I am not being entirely rigorous. A pet peeve of mine is the amount of decoration mathematicians use in their notation, but you need it to be entirely precise. That’s why I’m blogging! And celebrating notational conventions that cut back on the decoration.

I warned you at the top you’d have to bear with me.